Bitcoin (BTC) closed the week at its lowest level since May, ending at $100,970. BTC fell below $99,000 at one point due to fears sparked by escalating geopolitical tensions.

However, top experts in the market remain optimistic, even as overall sentiment has shifted from neutral to fearful.

What Are Experts Saying About Bitcoin Dropping Below $100,000?

As BeInCrypto reported, Bitcoin slipped below the $100,000 mark after Iran threatened to shut down the Strait of Hormuz. This marked a serious escalation in tensions following US attacks on Iran.

Instead of panicking, leading industry experts stayed optimistic. They based their confidence on technical analysis and macroeconomic factors.

Raoul Pal, Founder and CEO of RealVision, shared his perspective alongside a chart comparing the global M2 money supply to Bitcoin’s price. He argued that Bitcoin falling below $100,000 is not surprising, considering its strong correlation with the growth of the global M2 supply.

The chart shows that Bitcoin typically follows M2 growth with a 12-week lag. Pal emphasized that investors shouldn’t expect every short-term movement to match perfectly. What matters more is the overall context.

“Nothing seems unusual here but please do not expect all wiggles to match or all timing points to be exact, it’s the overall contextualization that matters the most… and yes, alts bleed more than BTC in corrections,” Raoul Pal said.

Arthur Hayes, former CEO of BitMEX, shared a similar view. He predicted that central banks—especially the US Federal Reserve—would soon restart aggressive money printing. In a previous analysis, Hayes argued that loose monetary policy could drive Bitcoin’s price to skyrocket, potentially even reaching $1 million.

“Do you hear that? … it’s the sound of the money printers revving up to do their patriotic duty. This weakness shall pass and BTC will leave no doubt as to its safe haven status,” Arthur Hayes said.

His view strengthens the belief that Bitcoin, often dubbed “digital gold,” will benefit from money-printing policies during economic and political uncertainty.

On the technical side, popular analyst TechDev also offered a positive outlook. While he acknowledged that BTC might drop further, he remains confident in a major rebound.

“$95,000 would make sense structurally. Then $170,000 is closer than you think,” TechDev said.

Additionally, major industry figures like Binance founder CZ and Ran Neuner, founder of Crypto Banter, also expressed strong confidence in Bitcoin’s recovery.

Data Shows Retail Sentiment Diverges from Market Movements

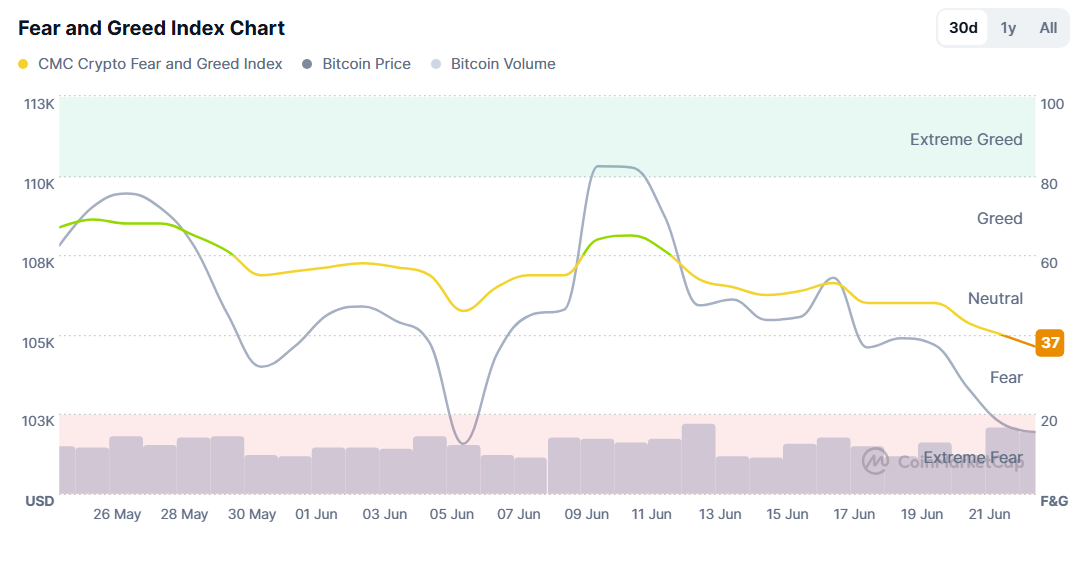

While experts remained optimistic amid rising political tensions, retail sentiment painted a different picture. According to CoinMarketCap, the Fear and Greed Index dropped from 65 to 37 in June. This shift reflects a transition from greed to fear among retail investors.

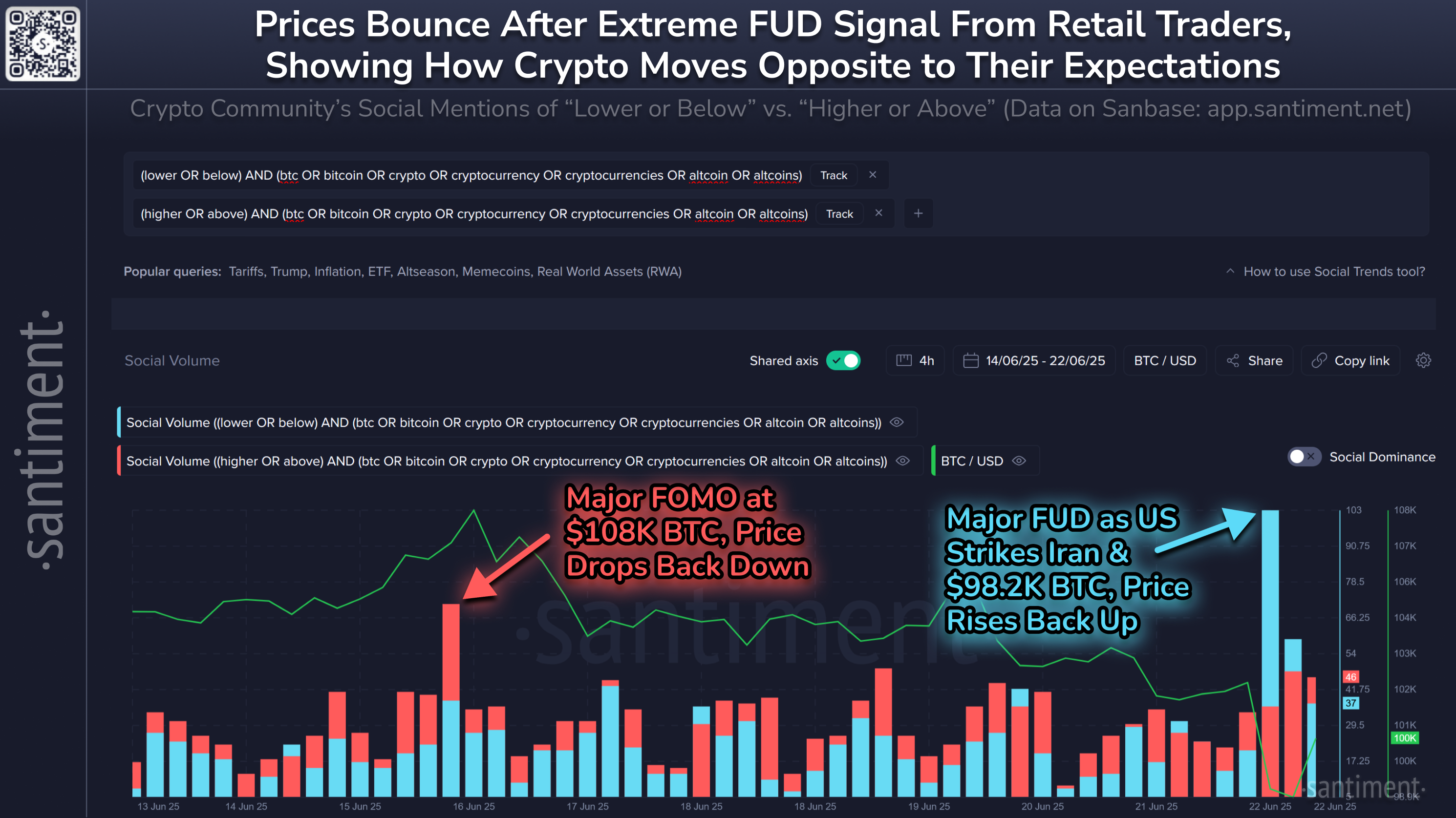

However, Santiment’s analysis suggests that Bitcoin often moves against the sentiment of retail investors. Social volume data indicates that overly positive discussions have recently coincided with price drops. Meanwhile, during periods of extremely negative discussions—such as the recent US-Iran conflict—Bitcoin’s price has tended to recover.

“With all of the real world concern and uncertainty in crypto now, the price swings for this upcoming week should be simple:Retail calls for ‘lower’ or ‘below’ = price goes UPRetail calls for ‘higher’ or ‘above’ = price goes DOWN,” analyst Brianq from Santiment said.

At the time of writing, Bitcoin has recovered and is trading above $101,000, adding further weight to the forecasts shared by these experts.

Still, the next moves by world leaders involved in the conflict remain unpredictable. These developments could shift the market in ways that many investors might not expect.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.